Which Best Describes a Sole Proprietorship

Members or officers carrying on a business that is a separate legal entity. Quarterfreelp and 13 more users found this answer helpful.

Fin 370 Final Exam 54 Questions With Answers The New Exam 1st Set Buy This One 30 Off Exam Final Exams Finals

Why is liability disadvantage of sole proprietorship.

. In a sole proprietorship the company and the owner are one and the same in terms of taxes and legal matters while a single-member LLC provides a divide between the Company and the owners in both tax and legal matters the business and the owner are considered separate entities. Sole proprietorships are the most basic forms of business organization in the United States. It is the preferred form of business ownership because of its simplicity O b.

Which of the following best describes sole proprietorships. Note that unlike the partnerships or corporations. Certain types of businesses are ideally suited for the sole proprietorship business form while others call for more complex forms of organization such.

One owner of a sole proprietorship pays income tax on the profits earned by the business since the business is not incorporated. A Sisters who make custom wedding gowns from a shop in their home. Definition of Sole Proprietorship.

B A man who owns and operates a lawn mower repair business by himself. A Forming a sole proprietorship is easy and does not cost a lot. C The sole proprietor owns all of the business and has the right to receive all of the businesss profits.

C A consulting firm called AAA Engineering Incorporated. Click card to see definition. Sole proprietorships-also called sole traders or proprietorships-are unincorporated businesses that are owned by one person and that are subject to personal income tax.

An individual owning and running a. Two or more people carrying on an unincorporated business B. Question 8 1 pts Which of the attributes best describe a sole a proprietorship.

One may also ask which best describes a sole. In addition to their ease of starting up and dismantling sole proprietorships are popular with small business owners and contractors because government involvement is. Which of the following best describes a sole proprietorship.

A business owned by an individual. A sole proprietorship is distinguished by being owned and run by one person. D A criminal law firm with multiple senior partners.

There is no legal separation between the owner and the business. The legal characteristics of. Unlimited liability for the owner.

It is the simplest legal form of a business entity. Sole proprietorships generate about 40 percent of all sales in the United States. The owner bears direct responsibility for all elements of the business and is fully accountable for all finances including debts loans and losses.

Which of the following is the main 1. A sole proprietorship or sole trader is an unincorporated business with a single owner who pays personal income tax on profits earned from the business. Sole proprietorship has a single owner while partnerships has two or more owners.

Corporation A corporation is a legal entity created by individuals stockholders or shareholders. Which of the following best describes a sole proprietorship. The word sole means only and proprietor notes to owner.

Separation of ownership and management. What Is The Best Description Of A Sole Proprietorship. The sole proprietor has unconditional and full control over its business.

Which of the following businesses represents a sole proprietorship. One owner of a sole proprietorship pays income tax on the profits earned by the business since the business is not incorporatedIn addition to their ease of starting up and dismantling sole proprietorships are popular with small business owners and contractors because government involvement is minimal. Sole proprietorships do not have to pay employment taxes.

A sole proprietor has full control. Sole proprietorships are the most common form of business organization in the United States. Which Best Describes A Sole Proprietorship.

Two or more people carrying on an unincorporated. Sole proprietorships can be owned by more than one person. Which best describes a sole proprietorship.

A sole proprietorship also known as individual entrepreneurship sole trader or simply proprietorship is a type of unincorporated entity that is owned by one individual only. Having a sole proprietorship is the most straightforward way to start or end a business because government regulations do not apply. Sole proprietorships act as pass-through entities in the eyes of the law and are treated as the business activities of individuals for tax purposes.

Agents operating businesses independently of each other D. Which of the following is the main disadvantage of forming a general partnership. The owner could lose personal property if.

B The owner has the right to make all management decisions concerning the business including those involving hiring and firing employees. Which advantage of a sole proprietorship could also be a disadvantage. All risks are to be borne by the sole proprietor.

For this option there is no legal distinction between the business and the owner. A sole proprietorship is a type of business entity thats run and owned by a single person. The sole proprietor of a business is protected from liability for debts of the business if the assets of the business are kept separate from personal assets O c.

It is that type of business organization which is owned managed and controlled by a single owner. A sole proprietor is the beneficiary of all profits.

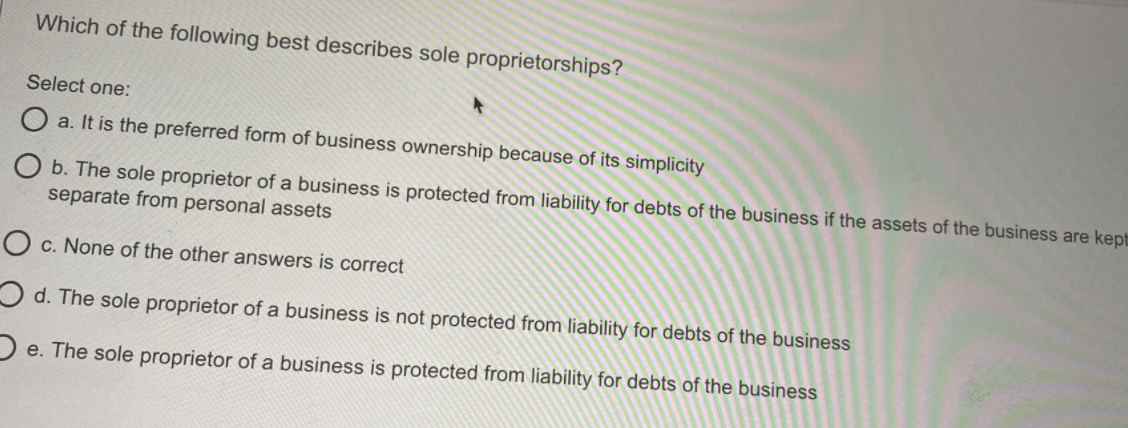

Solved Which Of The Following Best Describes Sole Chegg Com

Sole Proprietorship Definition Features Characteristics Advantage Disadvantages

No comments for "Which Best Describes a Sole Proprietorship"

Post a Comment